For some investors, bonds are a conundrum. Fixed-income investments have long been recommended, but grasping the nuances of the bond market might be a challenge. Investing in a bond index fund is a simple method to solve the challenge. In a complete bond market fund, you have exposure to the entire bond market when you purchase shares. Assets in U.S. government bonds, agency and corporate debts, and other fixed-income investments may all be held in one fund for a cost of 15 basis points or less.

Bonds are an essential part of both your retirement and taxable investment portfolios. A total bond market fund may help lessen the overall volatility of your portfolio, whether you want to design a two-fund or three-fund portfolio or a more sophisticated structure. Investments in medium to long-term bonds are the primary focus of long-term bond funds. These investments are more vulnerable to fluctuations in interest rates and hence more volatile than other forms of debt.

Fidelity Total Bond Fund

Investing in the Fidelity Total Bond Fund means getting a lot of current income. The Bloomberg US Universal Bond Index acts as a benchmark for the fund's investments. Approximately 75% of the fund's assets primarily invested in different forms of debt securities. After that, it invests around 15% of its assets in lower-rated debt instruments. In comparison to investment-grade debt instruments, these junk bonds carry a greater level of risk but also a higher yield. To raise leverage, the fund trades in the derivatives market, which carries with it certain sorts of risk. Swaps, options, as well as futures contracts are all derivatives.

As of October 2020, the Fidelity Total Bond Fund has $16.2 billion with assets in management (AUM) and a 30-day SEC yield of 2.02%. The fund's debt instruments had an average remaining maturity of 5.23 years on average. The fund's volatility has been modest in the past. Investment-grade bonds accounted for over 76 percent of its total holdings, with U.S. government bonds accounting for over 26 percent of that total. No minimum investment was required, and the cost ratio was 0.45 percent.

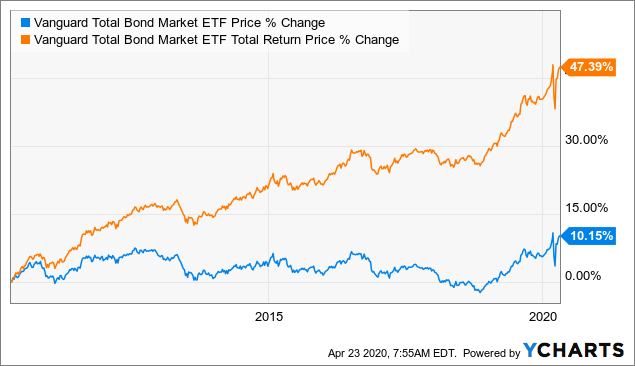

Vanguard Total Bond Market

Bonds with a credit rating of A+ or above are included in the Vanguard Total Bond Market ETF. A total of 59% of the fund's assets will be invested in U.S. government bonds of all maturities by October 2020. 41 percent was invested in other high-quality bonds. Over 90% below the average cost ratio of funds with comparable assets, it had an extremely low expense ratio of just 0.035 percent. The cost ratios of Vanguard funds are among the lowest in the industry.

With a 1.21 percent SEC yield, this Vanguard Total Bond Market Fund has net assets of $288.5 billion ($60.7 billion in the ETF). With 9,881 assets, the average effective maturity was 8.5 years, and the median length was 6.5 years. Investing in an ETF does not need a minimum initial investment.

Dodge & Cox Income Fund

Long-term capital preservation and current income growth are both important goals for The Dodge & Cox Income Fund. In general, investment-grade securities make up around 80% of the company's assets, with debt obligations rated below investment grade making up about 20% of the total. Although DODIX lacks the name awareness of Vanguard or BlackRock, it is a secure and reliable core holding. The SEC yield of the Dodge & Cox Income Fund was 1.99 percent, while the cost ratio was 0.42 percent. As of October 2020, it has net assets of $64.2 billion inside its portfolio. Investing in the fund begins with a $2,500 down payment.

Vanguard Tax-Exempt High-Yield Fund

Tax-free income is the goal of the Vanguard High-Yield Tax-Exempt Fund (VWAHX, $12.08), a bond fund. Investors seeking tax-free income from bonds kept in taxable brokerage accounts will find this an excellent option. Even while a 1.5% SEC return may not seem like much, keep in mind that it is tax-free. For individuals in the highest tax band, the "tax-equivalent yield" – the return you would have to obtain on a taxable product to match the take-home income of VWAHX – is 2.4 percent.

VWAHX is a possible winner in 2022 since it holds up to 80% of its assets, including investment-grade municipal bonds, apart from the tax advantages. Comparatively to better-quality corporate bonds and Treasury securities, which are often featured in aggregate bond index funds, they may earn higher yields and possibly bigger profits in an environment of increasing interest rates.

Conclusion

By 2022, the top bond funds will be able to mitigate the negative effects of decreasing prices and increasing interest rates, despite the bleak outlook for the fixed-income market. They will also assist in extracting any prospective advantages that may be taken advantage of.

How To Get The Best Rates On Renter's Insurance

How Do You Define The Russell 3000?

How to File Your Gig Workers Taxes?

Demystifying the Role of Certified Financial Planners (CFP)

Maximizing Savings: Top 10 Tax Deductions and Breaks for 2023-2024

Understanding Credit Inquiries: Unraveling the Mystery Behind Hard and Soft Inquiries

Big Board Explained: Understanding Its Meaning, Rules, and Impact on Markets

Comparing Ordinary and Qualified Dividends in Investment Income

Emergency Fund Calculator: How Much Will You Need?

Real Estate and Form 1099-A: Key Considerations for Property Owners

Understanding the Basics of a Market Economy: A Comprehensive Guide